Geoff Wilson BREAKS the Internet.

Geoff Wilson, the founder of Sports Card Investor (SCI), is one of the most influential — and polarizing — figures in the modern sports card hobby. He launched SCI during the hobby's resurgence and played a major role in turning card collecting into a more investment-oriented, content-driven space.

Here’s how he got started and changed the game:

🧠 WHO IS GEOFF WILSON?

-

A tech entrepreneur (founded a successful software company, 352 Inc.)

-

Lifelong sports fan and former card collector in the 1980s–90s

-

Returned to the hobby in the late 2010s as card prices began heating up

🚀 HOW HE STARTED SPORTS CARD INVESTOR (SCI)

Launched in 2019, just as the card market was entering a new boom:

-

Created a YouTube channel, mixing sports card news, pricing analysis, and investing tips

-

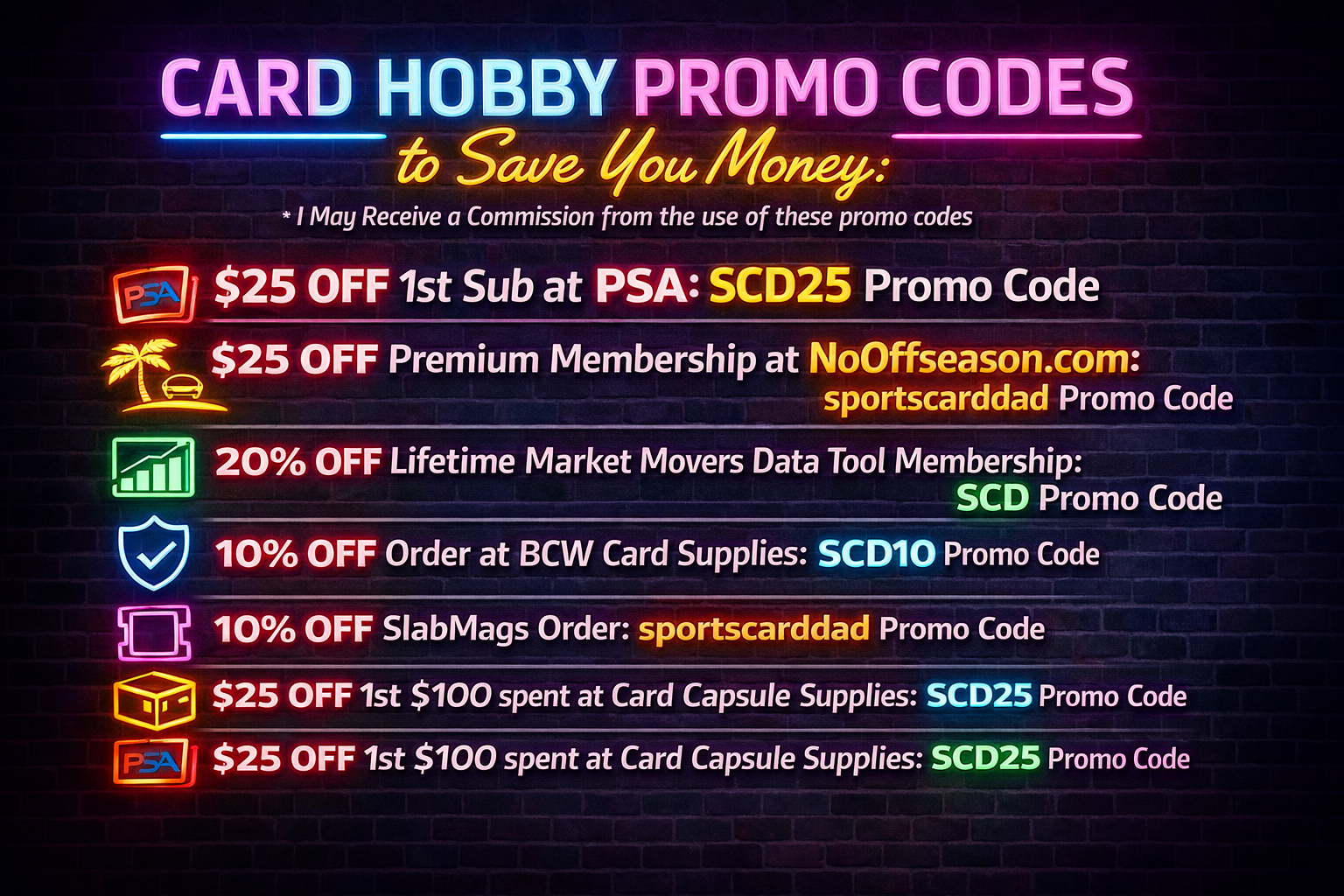

Introduced the Market Movers app, a paid data platform for tracking card prices over time

-

Grew SCI into a full-on media brand with:

-

Interviews, podcasts, livestreams

-

Card investment strategy videos

-

Pop culture coverage (Pokémon, Marvel, NFTs, etc.)

-

🔁 HOW HE CHANGED THE HOBBY

💸 1. Pushed Cards as Alternative Investments

-

Popularized the idea that sports cards are like stocks or crypto

-

Used phrases like “buy low, sell high” and “card investing strategies”

-

Attracted a new wave of flippers, entrepreneurs, and investors

Impact: Many credit (or blame) him for the influx of “money-first” collectors.

📊 2. Made Market Data Accessible

-

Market Movers gave collectors pricing charts, historical trends, and ROI analysis — a first in the hobby at that scale.

-

Influenced how people evaluate cards: not just based on nostalgia, but on performance and price velocity

📽️ 3. Created Hobby Content at Scale

-

Made regular YouTube videos about:

-

Card price trends

-

“Hot cards” of the week

-

Trade show coverage (e.g., The National, Dallas Card Show)

-

-

Built one of the largest hobby channels, helping mainstream the hobby on social media

🌐 4. Brought Professionalism and Controversy

-

Treated the hobby like a business: polished content, affiliate programs, branded events

-

Helped bring corporate sponsors and mainstream attention to cards

-

Also drew criticism for:

-

Overhyping short-term “investment” plays

-

Conflicts of interest (e.g., promoting cards he owned)

-

Selling access to data behind paywalls

-

🧠 LEGACY & CURRENT ROLE

Today, Geoff and SCI are still active with:

-

Weekly YouTube content

-

An expanded Market Movers platform

-

Partnerships with grading companies, marketplaces, and apps

He helped turn card collecting from a niche hobby into a multi-billion-dollar investment market — for better or worse.

🎯 In Summary:

| 🔥 Impact | 😬 Controversy |

|---|---|

| Pioneered card investing | Promoted hype & FOMO |

| Built hobby media brand | Paywalls for price data |

| Introduced pricing tools | Conflict-of-interest risks |

| Professionalized hobby | Shifted focus from fun |

Here’s a breakdown of Sports Card Investor (SCI) vs. other major players in the hobby — especially if you’re using them to track card prices, consume content, or analyze trends.

🥇 1. Sports Card Investor (SCI)

Founder: Geoff Wilson

Best For: Hobby newcomers, investors, YouTube-first users

Core Product: Market Movers platform

✅ Pros:

-

Strong YouTube presence — clear, consistent, professional content

-

Market Movers is fast and user-friendly

-

Includes charting, trends, comps, and collection tracking

-

Easy for beginners to understand market swings

⚠️ Cons:

-

Market Movers is paywalled (no free option for price charts)

-

Perceived as “too hype-driven” by some veteran collectors

-

Conflict-of-interest concerns (influencing prices of cards he owns)

-

Focus is often on ultra-modern and flipping

🧠 2. Card Ladder

Founders: Chris McGill (Cardboard Chronicles), Josh Johnson (former PSA), Christina Thorson

Best For: Data nerds, high-end collectors, long-term investors

Core Product: Card Ladder Pro database

✅ Pros:

-

Highly accurate, curated sales data across marketplaces

-

Includes PSA pop report integration, price laddering, and portfolio ROI

-

Tracks modern, vintage, and rare inserts — not just hot rookies

-

Clean interface with public charts on some cards

⚠️ Cons:

-

Also paywalled for full features (some free cards tracked)

-

Less flashy; limited video content

-

Smaller library of lower-end cards

-

Not ideal for flippers chasing the next big thing

📈 3. Alt (OnlyAlt.com)

Best For: Tech-savvy investors, high-end card traders

Core Product: Alt Value Index and vaulting services

✅ Pros:

-

Offers real-time “Alt Value” pricing based on market comps

-

Integrated vault, marketplace, and portfolio tools

-

Strong for graded cards and high-end buyers

-

No need to research comps manually

⚠️ Cons:

-

Some prices rely on Alt’s own model — not pure market comps

-

More investment/finance-forward than collector-focused

-

Limited video content or creator community

🧾 4. eBay (Sold Listings + Terapeak)

Best For: Raw price checks, everyday transactions

Core Product: eBay sold/completed items

✅ Pros:

-

Free

-

Real transactions — often most reliable for comps

-

Covers any and all cards, even obscure stuff

⚠️ Cons:

-

Clunky for volume users

-

No charts or performance tracking

-

Doesn’t account for shill bidding or best offer negotiations