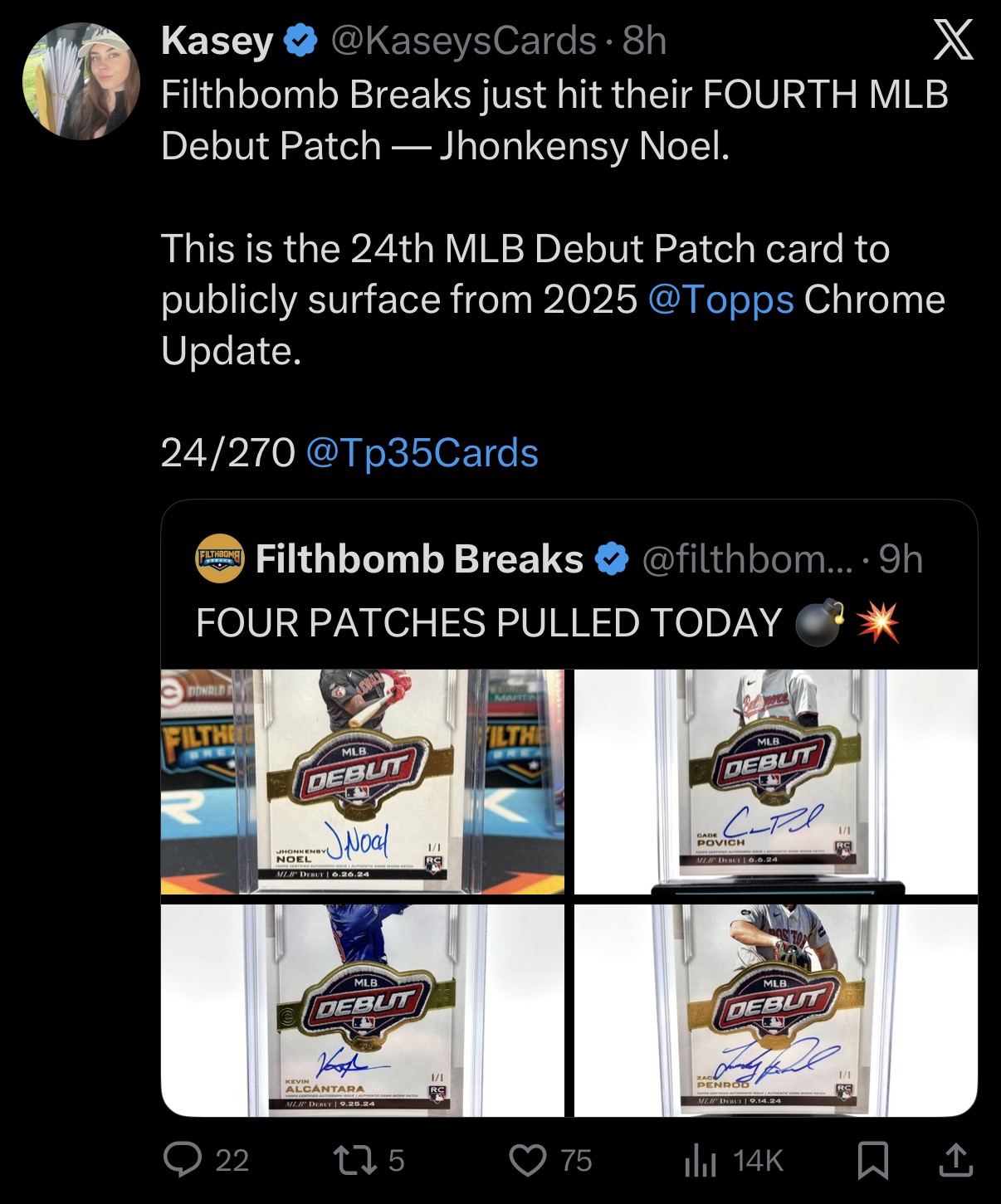

FilthBomb Breaks PULLS 3 MLB Patches in 4 Boxes

Who is Filthbomb Breaks?

Filthbomb Breaks is a live sports card breaker and seller that hosts live box and case breaks across major platforms like Fanatics Live, Facebook, Instagram, and YouTube. They break a wide range of products — MLB, NFL, NBA, NHL, soccer, and more — often offering pick-your-player or pick-your-team style breaks. Filthbomb Breaks+1

According to their official profile on Fanatics Live, they’ve been active for years and have built a community around daily live breaks, positioning themselves as passionate collectors and entertainers. Fanatics Live

They also have an online store and social media presence where they promote breaks, merch, and community events tied to card breaking. Instagram

📈 Are They the Largest Breaker on Fanatics Live?

There’s no official ranking system published that declares one breaker as the absolute “largest” on Fanatics Live (like by revenue, number of breaks, or audience). However:

-

Filthbomb is one of the more prominent and active breakers on Fanatics Live, appearing regularly in the live listings and often showing large case breaks. Fanatics Live

-

Many collectors recognize them as a big presence due to the volume of breaks and the high-profile nature of some of their offerings.

-

That said, community sentiment is mixed: some card hobbyists enjoy their shows, while others criticize their pricing, hype style, and marketing tactics. Reddit

So they’re certainly a major player, and for many collectors they feel like one of the larger breakers — but there’s no definitive leaderboard proving they’re the absolute largest on Fanatics Live.

Breaking sports cards is easily a multi-billion-dollar global business when you add up all the product being ripped on Fanatics Live, Whatnot, TikTok, YouTube, IG, LCS streams, etc. Nobody publishes a clean “breaks only” number, but we can triangulate from trading-card market data and livestream-commerce stats to see just how big it’s gotten.

1. The size of the overall sports-card pie

First, zoom out.

-

The global sports trading card market was estimated at $11.52 billion in 2024, with projections to hit $23.64 billion by 2034.Giant Sports Cards+1

-

In the U.S. alone, one recent industry report pegs the 2024 sports-trading-card market around $1.3 billion, forecast to almost double by 2033.Deep Market Insights

That’s all forms of sports cards: sealed wax, singles, grading, retail, secondary market, etc. The key question is: how much of that flows through breaks?

We don’t get a clean percentage from Fanatics or Panini, but we do have strong directional clues:

-

In an ESPN feature on box breaks, one major breaker, Layton Sports Cards, said 90–95% of their sales were from breaks, not traditional singles or in-store sales.ESPN.com

-

A number of shops have pivoted to being almost entirely “online breaking studios” with a storefront bolted on, instead of the classic LCS model.

If you assume even 25–40% of global sports-card spending is now rip-and-ship or break-driven (a conservative range given those anecdotes), you’re already talking about several billion dollars of product annually being opened via live breaks by 2025.

2. Livestream platforms: the revenue firehose

The best hard numbers come from the livestream-commerce side, where trading cards are a top category.

Whatnot

-

Whatnot’s GMV (gross merchandise value) was about $3 billion in 2024, with estimated $359 million in platform revenue.Sacra+2Fortune+2

-

Trading cards (sports, Pokémon, TCGs) are consistently cited as one of the core pillars of the platform, and Whatnot just raised funding at an $11–11.5 billion valuation in 2025 on the back of that growth.Sports Collectors Daily+1

Even if we very conservatively say only one-third to half of Whatnot’s GMV is sports and sports-adjacent card breaks, that’s $1–1.5 billion per year in card-related product moving through one platform.

Fanatics Live

-

Fanatics Live launched in 2023 specifically to target live sports-card breaking and other collectibles.Forbes+2Beckett+2

-

In 2024, Fanatics Live acquired the assets of European live-commerce platform Voggt, explicitly describing its focus on “live selling of sports collectibles, known in the collectibles space as ‘breaking.’”Fanatics Inc

Fanatics doesn’t publish revenue by channel, but given how aggressively they’ve pushed Debut Patches, exclusive allocations, and cross-promos, it’s clear they see breaking as a central monetization engine—not a side hobby.

The broader live-selling boom

Outside the hobby, live selling as a whole is exploding:

-

Articles on livestream shopping show individual sellers doing six-figure sales in a single marathon show, with relatively low startup costs but big upside if you can build an audience.markets.businessinsider.com

-

A 2025 analysis of the trading-card market calls out live streaming platforms like Whatnot, Fanatics Live, and Twitch as turning card breaking into “a full-on spectator sport,” especially for younger demographics who grew up with Twitch chat and YouTube streaming.Customvending.com

Combine all this and it’s reasonable to say that by 2025, card breaks are one of the single biggest channels for selling sealed product, easily handling billions in GMV globally.

3. Real-world examples: from side hustle to eight-figure businesses

To get a feel for scale, look at a few individual operators:

-

Former NFL linebacker Blake Martinez launched “Blake’s Breaks,” a Pokémon-focused break business that reportedly did over $11.5 million in revenue in its first year before running into controversy and getting banned from Whatnot.Talksport

-

In the UK, “The Yorkshire Collector” (Adam Whittaker) went from pharmacy manager to running a multi-million-pound sports-card business on Whatnot, with a full-time team and high-end breaks where spots can cost from a few hundred to tens of thousands of pounds.Talksport

These are just two public examples. There are many mid-tier breakers quietly doing seven-figure annual revenue in sealed wax + breaking fees, plus dozens (if not hundreds) of hobby shops for whom breaks are the majority of their business.ESPN.com

On the other end, you’ve got thousands of small breakers streaming to 5–50 people, maybe doing a few hundred to a few thousand dollars per week. The long tail is huge—and collectively, it adds up.

4. How breakers actually make money in 2025

By 2025, the economic model of breaking has matured:

-

Margin on sealed product

-

Breakers buy at distributor or direct pricing and then sell slots, teams, or players at a markup over the box/case cost.

-

One Reddit analysis of break pricing for a high-end 2023 football product showed some breakers netting over $1,000 profit on a single break.Reddit

-

-

Platform take rates

-

Platforms like Whatnot take ~8% marketplace fee plus payment-processing costs on each transaction, which is how they turn billions of GMV into hundreds of millions in revenue.Sacra

-

-

Tip culture & add-ons

-

Buyers tip, buy add-on packs, or chase additional “hit drafts” and repacks.

-

Some major breakers now have their own branded repack products or membership tiers.

-

-

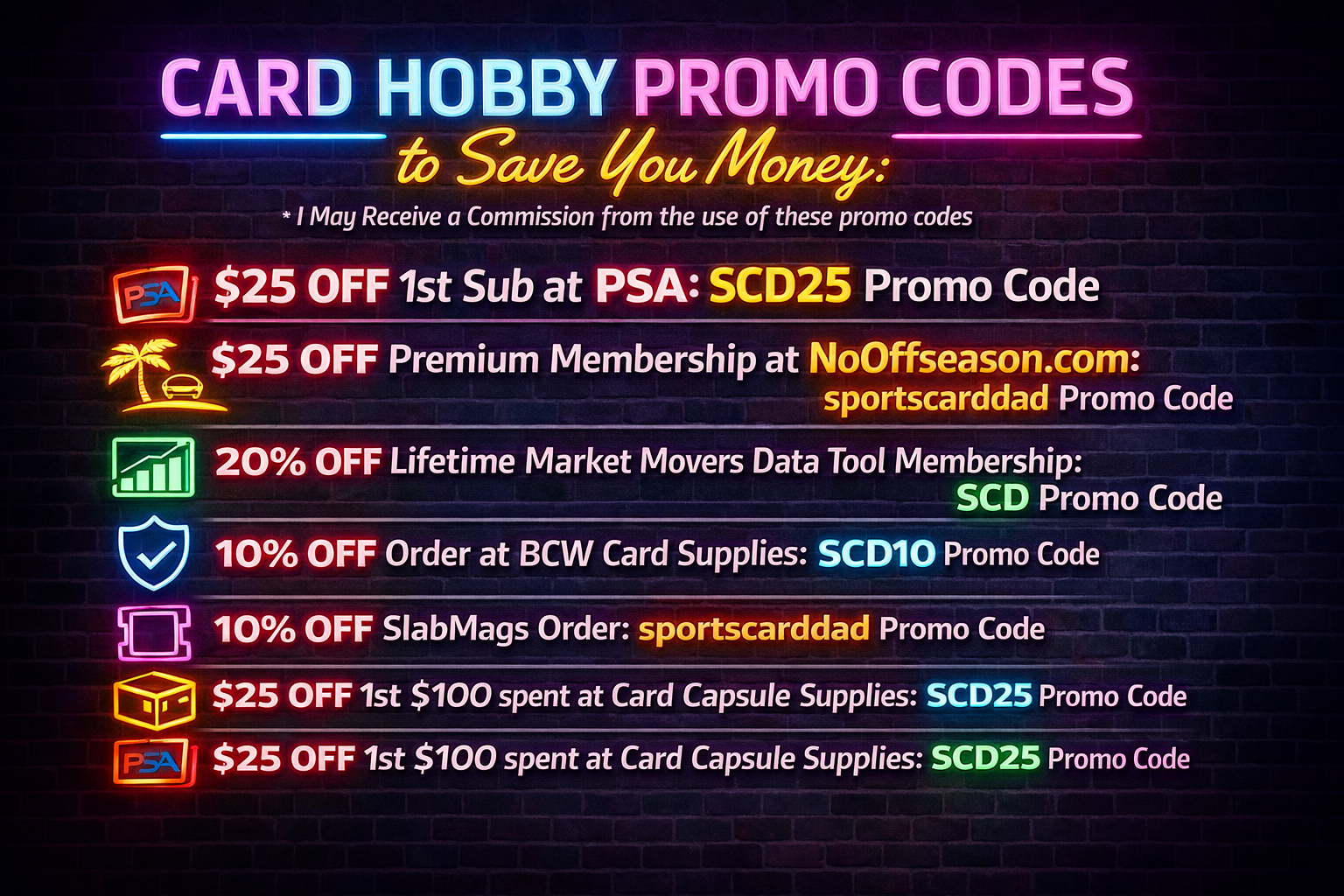

Brand & sponsorships

-

Big channels land sponsorships from grading companies, supply brands, even auctions or casinos.

-

The top breakers start to look less like card shops and more like media companies that also sell wax.

-

5. Why 2025 is a turning-point year

A few forces make 2025 feel like a “post-gold-rush but still huge” era for card breaks:

-

Market normalization after the pandemic boom

The overall card market cooled from the 2020-2021 mania but stabilized at a much higher baseline. The 2024 global market value of $11.52B is already more than double some pre-pandemic estimates.Zion Market Research+1 -

Platform wars: Whatnot vs Fanatics Live vs everyone else

You’ve now got:-

Whatnot scaling to multi-billion GMV.Sacra+1

-

Fanatics Live being built into the Fanatics ecosystem with direct access to Topps allocations and exclusive products.Fanatics Inc+1

-

TikTok, Instagram, YouTube, Twitch all hosting breaks in parallel.

That makes 2025 less about “Can breaking be big?” and more about who controls the firehose.

-

-

Breaking as entertainment, not just commerce

Academic and media pieces describe live breaks as a hybrid of “game show, gambling, and community hangout,” where the dopamine hit comes from watching the rip as much as owning the card.Pamela Rutledge+1 -

Risk, regulation, and controversy

With those big numbers also comes:

All of that is exactly what you’d expect from a large, maturing industry, not a tiny hobby side-niche.

6. A reasonable estimate: how big is breaking specifically?

Because nobody reports a clean “box break revenue” line, any number here is an estimate—but we can bracket it:

-

Top-down from card market size

-

Global sports-card market ≈ $11.5B (2024).Zion Market Research

-

If 25–40% of sealed product is now distributed via breaks (a conservative range given some shops report 90%+ break-driven revenue), that’s $2.9–$4.6B in product value being ripped through breaks annually.

-

-

Platform-based estimation

-

Whatnot alone: $3B GMV, a large chunk in cards.Sacra+1

-

Add Fanatics Live, TikTok, IG, YouTube, Twitch, Facebook-group breaks, and offline LCS breaks.

-

It is very plausible that card breaks across all platforms are handling north of $3–5B in annual GMV by 2025, counting both sports and TCGs. Sports likely account for a major but not exclusive share.

-

-

Income for breakers themselves

-

Platform fees and costs aside, that’s still hundreds of millions of dollars in gross profit collectively going to breakers (big and small).

-

With examples of single operations doing $10M+ per year, it doesn’t take many big players plus a long tail of mid-sized shops to absorb those billions.Talksport+2Talksport+2

-

So while the exact figure isn’t published, a realistic 2025 headline would be:

“Sports card breaking is a multi-billion-dollar global channel, handling perhaps a quarter to a third of all trading-card product sold.”