Sports Card Hobby Hits PEAK Hysteria

Sports cards remain very popular in 2025, but the market has evolved since the pandemic-fueled boom of 2020–2021. While the high-end market is still strong, the overall sports card hobby has settled into a more stable and mature phase — with key trends emerging:

📈 1. Market Size and Growth

- The global sports trading card market is expected to reach $20 billion by 2027, growing at a compound annual growth rate (CAGR) of 7-9%.

- Basketball and soccer cards continue to drive market growth, but baseball and football remain staples in the U.S. market.

- The rise of online platforms (eBay, Whatnot, MySlabs, PWCC) has increased liquidity and access to cards.

➡️ Example: High-profile auctions on Goldin and PWCC are regularly setting records, especially for rare, low-population graded cards.

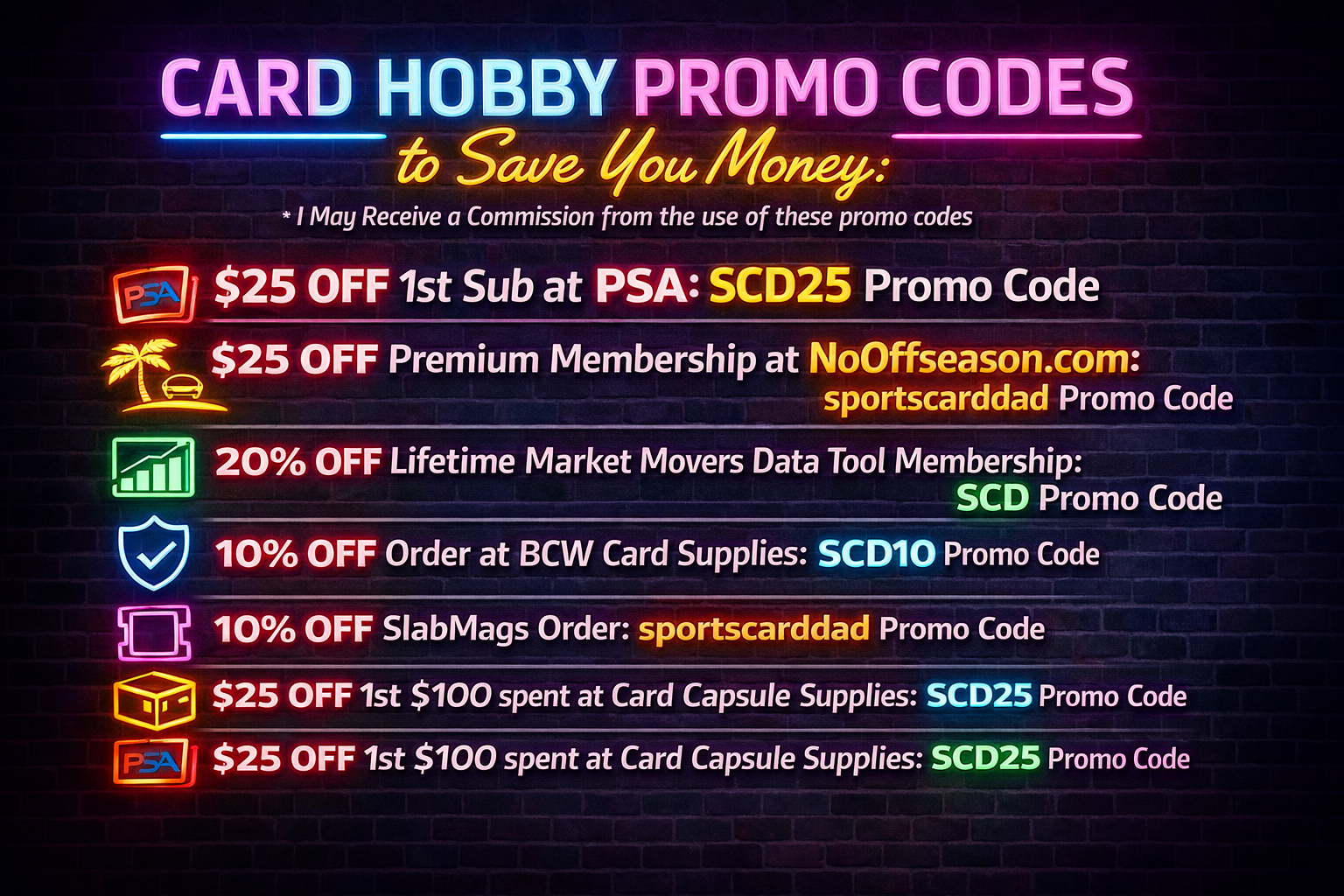

🔥 2. Increased Popularity of Graded Cards

- The demand for graded cards remains high, especially PSA 10s and BGS 9.5s.

- PSA, SGC, and Beckett continue to see strong grading volume — PSA alone is grading over 1 million cards per month.

- Modern collectors are focusing on population reports and trying to chase low-pop, high-grade cards.

➡️ Example: A PSA 10 Victor Wembanyama rookie sold for over $100K within weeks of release.

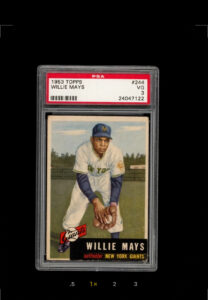

🎯 3. Shift Toward High-End and Vintage Cards

- The market for modern base cards has softened, but demand for numbered parallels, rookie autos, and short prints remains high.

- High-end vintage cards (like the 1952 Topps Mickey Mantle or 1986 Fleer Jordan) are still setting records.

- Collectors are focusing more on scarcity and investment-grade cards rather than mass-produced modern releases.

➡️ Example: A PSA 10 1986 Fleer Michael Jordan recently sold for over $500K — down from the $700K+ highs of 2021 but still extremely strong.

🎥 4. Content and Social Influence Driving Popularity

- The rise of platforms like Whatnot, YouTube, and TikTok has introduced a new generation to the hobby.

- Influencers like Geoff Wilson (Sports Card Investor) and platforms like Card Ladder are helping collectors track trends and prices.

- The "Rip and Ship" model (live pack breaks) has exploded, especially with products like Prizm, Select, and National Treasures.

➡️ Example: 2024 Prizm WNBA boxes sold out almost immediately due to influencer-driven hype.

🌍 5. Global Expansion

- Soccer cards and F1 cards have fueled growth in Europe and South America.

- The NBA’s global following has increased demand for basketball cards in Asia and Australia.

- Soccer rookies like Jude Bellingham and F1 stars like Max Verstappen are leading the charge in non-U.S. markets.

➡️ Example: A PSA 10 Erling Haaland rookie card sold for over $200K at Goldin.

🚨 Challenges Facing the Hobby in 2025

❌ Overproduction – Companies like Panini and Topps are producing a large volume of products, leading to “junk wax era 2.0” fears.

❌ Card Breakers and Market Saturation – Breakers are buying out high-end products, leaving collectors with limited retail access.

❌ Counterfeiting and Scams – The rise of AI-generated fakes and altered cards has led to increased scrutiny from grading companies.

🏆 The Overall Outlook in 2025

✅ The sports card hobby has matured — no longer a bubble, but a sustainable and growing market.

✅ The focus is shifting toward scarcity, quality, and authenticity — low-pop, high-grade rookies and numbered parallels are driving the market.

✅ High-end vintage and key rookie cards are expected to hold value and continue appreciating.

✅ Fanatics' takeover of Topps and other licensing deals will likely bring further innovation and product changes.

Sports cards and collectibles are expected to remain popular in 2026, but the market will likely continue to evolve based on several key factors:

📈 1. Fanatics' Dominance Will Shape the Hobby

- Fanatics holds exclusive licenses for MLB, NBA, and NFL cards starting in 2025 — essentially giving them a monopoly on the major U.S. sports card market.

- Fanatics has already shown it’s committed to growing the hobby through:

- Direct-to-consumer sales (cutting out distributors).

- Increased focus on rookie patches, autos, and on-card signatures.

- Integrating sports betting and live card breaks into their ecosystem.

- The company's goal is to create a more collector-friendly experience — but some worry about higher prices and market saturation.

➡️ Example: Fanatics could bundle exclusive rookie autos with game tickets or VIP experiences — increasing both demand and price.

💻 2. The Rise of Digital and Blockchain-Based Cards

- The demand for physical cards will remain strong, but the rise of blockchain-based collectibles (like NBA Top Shot) will create a hybrid market.

- Companies are experimenting with:

- Digital twins — pairing a physical card with an NFT-based version for authentication.

- Augmented reality (AR) features tied to cards.

- Player interaction incentives (e.g., winning a signed jersey or meet-and-greet with a high-end pull).

➡️ Example: A physical Victor Wembanyama rookie card could have a QR code tied to an exclusive NFT highlight.

🌍 3. International Growth — Soccer and F1 Leading the Charge

- Soccer and F1 have experienced massive global growth, driving up demand for rookies and parallels.

- The 2026 FIFA World Cup will be held in North America (U.S., Canada, and Mexico), which will increase interest in soccer cards.

- Messi, Haaland, Mbappé, and Ronaldo cards are already highly sought after — expect that to increase leading up to the World Cup.

- F1's global expansion will also drive demand for rookie and race-used memorabilia cards.

➡️ Example: A PSA 10 Haaland rookie from Topps Chrome or Panini Prizm could spike in value if he dominates the 2026 World Cup.

🚀 4. High-End Market Will Continue to Surge

- The market for graded, low-population vintage cards (like Jordan, Mantle, Brady) will remain strong.

- Record-setting auctions at Goldin, PWCC, and Heritage suggest that rare, high-end cards will retain and grow value.

- Fractional ownership (like Collectable and Rally) will allow more collectors to buy into high-end cards.

➡️ Example: A PSA 10 Mickey Mantle 1952 Topps could surpass $15 million if market momentum holds.

🎯 5. Influence of Live Streams and Breakers Will Grow

- Platforms like Whatnot, Fanatics Live, and Drip will continue driving demand for modern product through live breaks.

- Breakers will likely have exclusive access to certain products under Fanatics’ model.

- Expect more “golden ticket” incentives (e.g., pulling a Wembanyama auto could win you courtside seats).

➡️ Example: A 2026 Fanatics Prizm NBA box could have exclusive live-streaming access tied to product openings.

🚨 Challenges Facing the Hobby in 2026

❌ Overproduction Risks – Fanatics and Panini could flood the market with too much product, creating a "junk wax 2.0" situation.

❌ Scams and Counterfeits – High-end cards remain vulnerable to fakes, trimmed edges, and altered slabs.

❌ High Entry Costs – The price of wax could continue to rise, pricing out casual collectors.

🏆 Predictions for 2026

✅ The market will stay strong — but expect a more mature and stabilized environment.

✅ High-end vintage will continue to rise in value due to scarcity and strong demand.

✅ Modern product will hold value primarily through autos, parallels, and rookies — base cards may lose value.

✅ Soccer and F1 cards will see a massive boost from the 2026 World Cup and continued F1 global expansion.

✅ Fanatics' influence will create a more corporate, controlled ecosystem — which could be good for stability but bad for product diversity.

🔥 Bottom Line:

Sports cards and collectibles will remain popular in 2026, but the market will shift toward:

- High-end, low-pop, and graded cards

- Soccer and F1 growth

- Fanatics-controlled product releases

- Premium collector experiences (like exclusive live breaks)